Comprehensive analysis of SEI Network ($SEI) as a specialized Layer-1 blockchain optimized for trading and DeFi. Covers technical advantages (200K TPS, 380ms finality), on-chain metrics (67.8% TVL growth, 851K DAUs), institutional catalysts (Wyoming WYST pilot, ETF filings), and price targets ($0.60-$1.12 EOY, $3-$6 by 2030). Includes risk assessment and strategic positioning for the 2025 altcoin cycle.

Listen up, degens and diamond hands alike—I'm an OG who's been knee-deep in this crypto trenches since the 2017 ICO gold rush. Now, in the thick of what feels like Altseason 3.0—with the Altcoin Season Index flirting with 82 and BTC.D cracking below 59%—$SEI is flashing signals that scream "undervalued gem with 5x–10x baked in."

**At $0.319 today (market cap ~$1.95B, ranking #58), SEI isn't the loudest voice in the room, but it's the one with the sharpest edge for trading-native DeFi.** This isn't blind optimism; it's a calculated bet on a chain built for speed in a market craving efficiency. SEI's potential isn't in moonshots alone; it's in becoming the Nasdaq of DeFi, capturing that trillion-dollar tokenized RWA wave while others lag.

---

Back in the day, I'd ape into any L1 promising "scalability," only to watch it choke on 10 TPS during a pump. SEI? It's laser-focused from day one: **the first sector-specific Layer-1 optimized for trading**, launching in August 2023 with Cosmos SDK roots and EVM compatibility.

- **Finality:** Sub-400ms (380ms actual)

- **Throughput:** 200,000 TPS post-Giga Upgrade (July 2025)

- **Architecture:** Cosmos SDK + EVM compatibility

- **Focus:** DEXes, order books, NFTs, high-frequency DeFi

- **Twin-Turbo Consensus:** Processes transactions in parallel

- **MEV Protection:** "Optimistic parallelism" lets trades settle without MEV meat grinder

- **Real Impact:** DEXes like DragonSwap and Sailor pulling $111M daily volume

- **Full EVM Support:** Devs can port Ethereum dApps overnight

- **IBC Integration:** Bridges to Osmosis, Injective, Secret Network

- **Institutional Rails:** Native USDC + Wyoming WYST stablecoin pilot

- **RWA Ready:** Tokenized treasuries and RWAs infrastructure

- **Utility:** Gas fees, staking (APY ~8–10%), governance, ecosystem grants

- **Circulating Supply:** 6.1B of 10B max

- **Vesting:** 70% still locked (gradual unlocks)

- **Backers:** Multicoin Capital (in at $0.005) - long-term aligned

OG Take: In 2017, we chased "Ethereum killers"—most flopped because they weren't specialized. SEI's trading-first DNA positions it as the "Nasdaq of DeFi." With DeFi TVL exploding to $70B market-wide, SEI's niche could capture 5–10% of that flow if it executes.---

I've always said: Charts are for traders, on-chain is for OGs. SEI's Q2 2025 was a masterclass in organic growth—no paid shills, just builders stacking value.

- **Price Performance:** Up 63.5% to $0.319

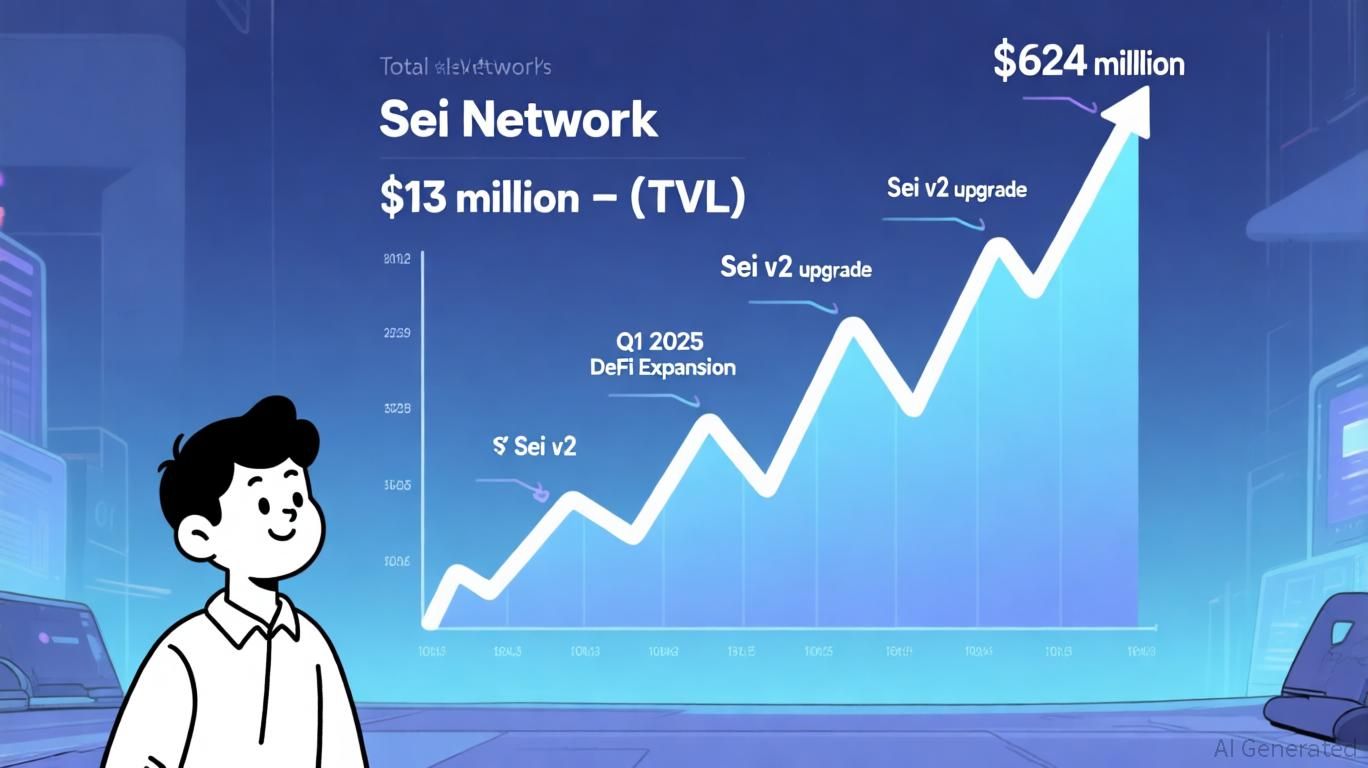

- **DeFi TVL:** Up 67.8% to $682M (July peak, now ~$600M post-dip)

- **Daily Active Addresses:** Exploding 36.6% to 851K+

- **Market Cap:** $1.95B (ranking #58)

- **Yei Finance:** 60% of TVL (Aave clone with SEI's speed twist)

- **Takara Lend:** Offering 8–10% yields on borrows

- **DEX Volume:** $111M daily

- **DragonSwap:** Leading EVM ports

- **RWA Integration:** U.S. government data oracles + FRNT stablecoin

- **Potential:** Tokenize $1T+ in assets by 2030 (Chainlink vision)

- **Gaming Activity:** 79% spike Q1 2025

- **Top Games:** World of Dypians, Archer Hunter, Enchanted Isles

- **SEI-Native Games:** 13/25 top games by UAW (DappRadar)

- **NFTs:** Yeiliens and YakaFinance trending

- **Installs:** 2M+ across games

- **IBC Transactions:** Up 25% YoY

- **Bridged Volume:** $5B+ to Cosmos hubs

- **Stablecoin Transactions:** $3T market-wide August

- **SEI Growth:** 15% via USDC/USDT pairs

- **Whale Accumulation:** Steady (10M SEI stacked in August)

- **Retail Transactions:** Under $10K up 9.7%

- **RSI:** 44 (neutral, ZoneCrypto heatmap)

- **MVRV:** -10% (screams undervalued)

OG Take: These aren't vanity metrics—851K DAUs is Solana-tier, but at 1/10th the market cap. TVL's 67.8% pop? That's real capital, not wash trading. In altseason (Index at 82), SEI's on-chain edge could flip it from #58 to top 30, especially as capital rotates from ETH/SOL to specialized L1s.---

SEI's chart is a classic "rounded bottom" after the March 2025 dip to $0.13—consolidating in a symmetrical triangle on the 4H, with $0.35 resistance and $0.27 support.

- **Pattern:** Symmetrical triangle consolidation

- **Support:** $0.27

- **Resistance:** $0.35

- **RSI:** 55 (bullish crossover incoming)

- **MACD:** Flipping positive

- **Volume:** Spiking 20% on Binance futures ($22M SEI/USDT pair)

- **Q3 YTD:** +22% vs. BTC (lagging alts like SOL +60%)

Short-Term (Sept–Oct 2025):

- Break $0.35 targets $0.44 (40% upside, AInvest)

- Fear & Greed at 52 (neutral)

- Altseason flows could push to $0.50 on FOMO

End-2025 Targets:

- Bullish forecasts: $0.60–$1.12 (Coinpedia, CoinLore)

- Conservative averages: ~$0.35–$0.40 (Changelly, CoinCodex)

- If TVL hits $1B and ETF rumors heat up: $1 in play (255% from here)

Long-Term (2026–2030):

- $3–$6 by 2030 (99Bitcoins, CoinDCX)

- Assumes DeFi/RWA adoption

- 2030 bull case: $4.17 (Coinpedia) if SEI captures 1% of $1T tokenized market

**OG Take:** At $0.319, SEI's undervalued vs. peers—SOL at $200 with similar TVL but 10x cap. The triangle breakout is imminent; volume on Binance (83% alt futures) will confirm. In 2021, I caught INJ at $1 (now $30+); SEI feels like that—stack below $0.30, target $1 EOY.---

SEI's not riding narratives blindly—it's stacking catalysts that align with 2025's macro tailwinds (Fed cuts, pro-crypto regs under Trump). Here's the playbook:

- **Wyoming WYST Stablecoin Pilot:** On SEI + Canary Capital's SEI ETF filing

- **Potential Inflows:** $1B+ unlocked

- **FRNT Stablecoin Integration:** Bridges TradFi, targeting tokenized treasuries (8–10% yields)

- **Crypto.com Custody:** Safe storage for whales

- **Sei Foundation 2025 Vision:** $95M raised from Jump Crypto/OKX Ventures

- **Funding:** Builder grants, hackathons, partnerships

- **Gaming:** 2M installs, 13/25 top UAW games

- **DeFi:** Monaco Protocol's sub-second execution draws HFT firms

- **NFTs:** XRPL bridges for coffee-themed drops like PortaXee

- **BTC.D <59%:** Capital rotation to L1s like SEI

- **Stablecoin Flows:** $60B Q3

- **Giga Upgrade:** 200K TPS positions against Solana outages

- **X Buzz:** @crypto_rand: "Do not fade $SEI" after Q2 metrics; @Satoshi_Jedi eyes $1 hold

- **Fed Rate Cut:** Sept 17 (25–50bps) injects liquidity

- **SEC Ripple Win:** Greenlights staking

- **Pro-Crypto Laws:** Could make SEI the U.S. gateway for DeFi

**OG Take:** These aren't pipe dreams—Wyoming's pilot is live, ETF filings are real. In 2021, institutional nods 3x'd chains like AVAX; SEI could 5x on RWA/DeFi convergence. The Foundation's "One-SEI" programs (community grants) ensure grassroots staying power. Catalysts align for Q4 breakout.---

No OG play is risk-free—SEI's got thorns:

- **L1 Fade Risk:** 90% of L1s fade post-hype

- **Weekly Forecast:** -23% (CoinCodex) if BTC dumps

- **Vesting Unlocks:** 30% by EOY could add sell pressure

- **Solana Dominance:** Meme dominance and Ethereum L2s (Base, Optimism) steal TVL

- **IBC Bridge Risk:** If bridges glitch, cross-chain flows dry up

- **Regulatory Delays:** Geopolitics or delayed regs could stall RWAs

- **Gaming/NFT Risks:** 79% Q1 spike, but rugs lurk (e.g., Kame exploits hitting memes)

- **TVL Fragility:** Dip post-$682M ATH signals fragility

- **DAU Requirements:** Needs 1M+ DAUs to sustain

**OG Take:** Risks are real—I've rekt bags on overhyped L1s. SEI's trading focus is a double-edged sword: Killer in bull, vulnerable in bear. Cap exposure at 5–10%; DCA below $0.30. If TVL stalls below $500M, fade it.

---

SEI isn't another "Ethereum killer"—it's the specialized scalpel for DeFi's bleeding edge, with 200K TPS, RWA rails, and Cosmos interoperability making it the go-to for tokenized trillions.

**At $0.319 and $1.95B cap, it's undervalued vs. SOL ($94B) despite matching on-chain fire (851K DAUs, 67% TVL growth).** Q4 catalysts—ETF, stablecoins, Fed liquidity—could rocket it to $1 EOY, $3–$6 by 2030 as RWAs hit $1T. In altseason's rotation, SEI's the mid-cap multiplier: Stack it for the flip from ETH/SOL profits.

- **40% large-cap hedge** (ETH/SOL)

- **30% SEI core**

- **20% memes for juice**

- **10% stables**

- Watch Binance order books for $10M+ USDT bids

- TVL breaks above $700M

- Triangle breakout above $0.35

**SEI's not a lottery—it's the infrastructure bet that prints in the next paradigm. Don't fade; accumulate.**

---

- Altcoin Season Outlook: September 14–20, 2025 - The Breakout Week - Weekly analysis of altcoin season breakout signals and strategic roadmap

- $SOL to $1000? The Megaphone Pattern That Could Send Solana Parabolic - Technical analysis of Solana's megaphone pattern and catalysts for new ATHs

- AI Agent Tokens Deep Dive: $SHELL, $FET, $VIRTUAL And The Road To New ATHs - Structured analysis of AI Agent token sector with $17B market cap

- Altcoin Season 2025: The OG's Guide to Navigating the $2T Altcoin Surge - Comprehensive analysis of 2025 altcoin season signals and trading strategies