Master blockchain scaling solutions with Layer 1 vs Layer 2 analysis. Learn about blockchain scalability, trading opportunities, and institutional-grade tools to identify profitable scaling solution investments.

Blockchain scaling represents one of the most critical challenges and opportunities in the cryptocurrency ecosystem, where the battle between Layer 1 and Layer 2 solutions is reshaping the future of decentralized finance and digital asset trading. As the cryptocurrency market matures and adoption increases, understanding the differences between Layer 1 and Layer 2 scaling solutions becomes essential for traders looking to identify profitable opportunities in this rapidly evolving sector. The ability to distinguish between competing scaling approaches and their investment potential can provide a significant edge in navigating the complex blockchain landscape.

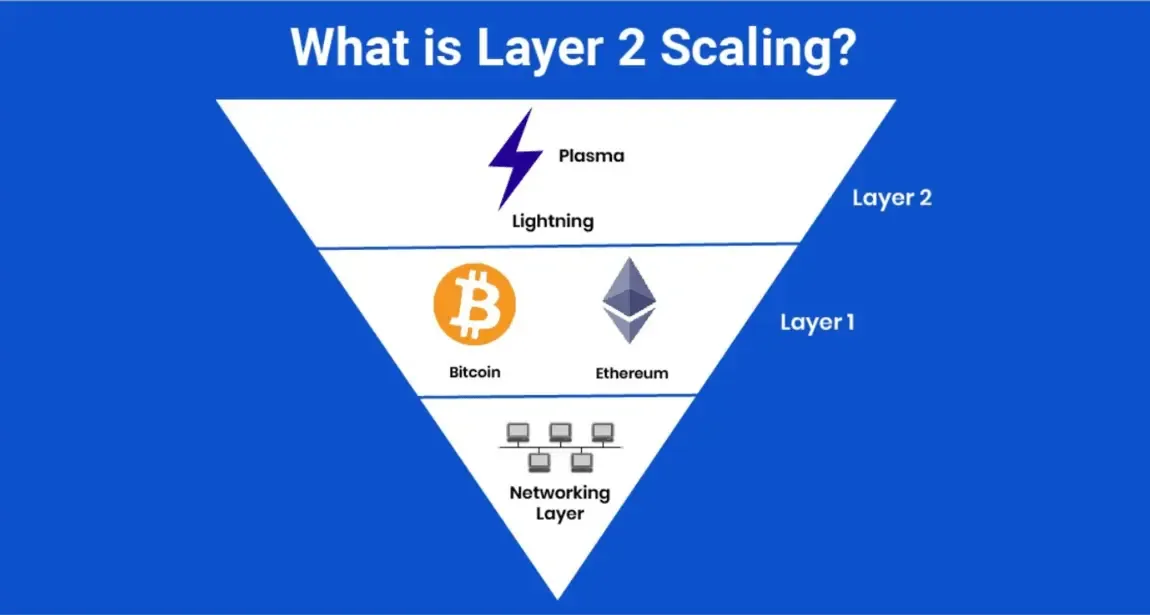

The scaling debate centers around how to increase blockchain transaction throughput while maintaining decentralization and security. Layer 1 solutions focus on improving the base blockchain protocol itself, while Layer 2 solutions build additional layers on top of existing blockchains to handle increased transaction volume. Each approach has unique characteristics, trade-offs, and investment implications that traders must understand to make informed decisions.

This comprehensive guide will explore the fundamental differences between Layer 1 and Layer 2 scaling solutions, their technical implementations, market dynamics, and trading opportunities. We'll also examine how modern AI-powered platforms like SoroMM are revolutionizing blockchain analysis with institutional-grade tools for identifying high-potential scaling solution investments.

Blockchain scaling refers to the process of increasing a blockchain network's capacity to handle more transactions per second (TPS) while maintaining decentralization, security, and efficiency. The scaling challenge arises from the fundamental trade-off between decentralization, security, and scalability—often referred to as the "blockchain trilemma."

Key Scaling Metrics:

- **Transactions Per Second (TPS):** Number of transactions processed per second

- **Block Size:** Amount of data that can be included in each block

- **Block Time:** Time required to create and validate new blocks

- **Network Throughput:** Overall capacity of the network to process transactions

- **Gas Fees:** Cost of executing transactions on the network

Decentralization:

- **Node Distribution:** Number and distribution of network nodes

- **Consensus Mechanism:** How network participants agree on valid transactions

- **Governance:** How network decisions are made and implemented

- **Censorship Resistance:** Ability to resist external control or manipulation

- **Network Security:** Protection against attacks and vulnerabilities

Security:

- **Attack Resistance:** Protection against 51% attacks and other threats

- **Transaction Finality:** Confidence that transactions cannot be reversed

- **Network Stability:** Reliability and uptime of the network

- **Smart Contract Security:** Protection against code vulnerabilities

- **Economic Security:** Cost of attacking the network

Scalability:

- **Transaction Throughput:** Number of transactions processed per second

- **Network Efficiency:** Resource utilization and optimization

- **Cost Effectiveness:** Affordability of network usage

- **User Experience:** Speed and convenience of transactions

- **Developer Experience:** Ease of building on the platform

Layer 1 solutions focus on improving the base blockchain protocol itself to increase scalability. These solutions modify the fundamental architecture of the blockchain to handle more transactions while maintaining decentralization and security.

Key Layer 1 Approaches:

- **Consensus Mechanism Changes:** Switching from Proof of Work to Proof of Stake

- **Block Size Increases:** Larger blocks to accommodate more transactions

- **Block Time Optimization:** Faster block creation and validation

- **Sharding:** Dividing the network into smaller, parallel chains

- **Protocol Upgrades:** Fundamental changes to blockchain architecture

Ethereum 2.0:

- **Proof of Stake:** Transition from PoW to PoS consensus

- **Sharding:** Division of network into 64 parallel chains

- **Beacon Chain:** Coordination layer for shard management

- **Staking Rewards:** Incentives for network validators

- **Energy Efficiency:** Reduced environmental impact

Solana:

- **Proof of History:** Time-based consensus mechanism

- **High Throughput:** 65,000+ TPS theoretical capacity

- **Low Fees:** Minimal transaction costs

- **Fast Finality:** Sub-second transaction confirmation

- **Developer Ecosystem:** Growing DeFi and NFT applications

Cardano:

- **Ouroboros Protocol:** Peer-reviewed consensus mechanism

- **Layered Architecture:** Separation of settlement and computation

- **Formal Verification:** Mathematical proof of security

- **Sustainability:** Long-term economic model

- **Interoperability:** Cross-chain communication capabilities

Layer 2 solutions build additional layers on top of existing blockchains to handle increased transaction volume without modifying the base protocol. These solutions inherit the security of the underlying blockchain while providing enhanced scalability.

Key Layer 2 Approaches:

- **State Channels:** Off-chain transaction processing with on-chain settlement

- **Sidechains:** Independent blockchains connected to main chain

- **Rollups:** Batch processing of transactions with compressed data

- **Plasma:** Hierarchical structure of child chains

- **Validium:** Off-chain data availability with on-chain proofs

Polygon (MATIC):

- **Sidechain Solution:** Independent blockchain with Ethereum bridge

- **High Throughput:** 7,000+ TPS capacity

- **Low Fees:** Fractional transaction costs

- **Ethereum Compatibility:** Full EVM compatibility

- **Growing Ecosystem:** Expanding DeFi and NFT applications

Optimism:

- **Optimistic Rollups:** Batch processing with fraud proofs

- **Ethereum Security:** Inherits Ethereum's security model

- **Fast Transactions:** Sub-second confirmation times

- **Developer Friendly:** Easy migration from Ethereum

- **Cost Effective:** Significant fee reduction

Arbitrum:

- **Optimistic Rollups:** Advanced rollup technology

- **Ethereum Compatibility:** Full EVM and Solidity support

- **High Throughput:** 40,000+ TPS capacity

- **Low Latency:** Fast transaction processing

- **Security Focus:** Strong emphasis on security and reliability

While traditional blockchain analysis relies on manual research and basic metrics, modern AI-powered platforms like SoroMM are revolutionizing how traders analyze Layer 1 and Layer 2 scaling solutions. SoroMM's institutional-grade technology provides sophisticated analysis tools that help traders identify high-potential scaling solution investments.

SoroMM's advanced algorithms provide comprehensive scaling solution analysis:

Technical Analysis:

- **Performance Metrics:** Real-time monitoring of TPS, fees, and latency

- **Network Health:** Analysis of network stability and security

- **Developer Activity:** Tracking code commits and ecosystem growth

- **Adoption Metrics:** Monitoring user growth and transaction volume

- **Competitive Analysis:** Comparison with competing solutions

Institutional-Grade Tools for Every Trader:

- **Professional Analysis:** Access institutional-level blockchain evaluation tools

- **Risk Assessment:** AI evaluates technical and market risks

- **Opportunity Identification:** Identify high-potential scaling investments

- **Portfolio Optimization:** Optimize allocation across scaling solutions

Market Analysis:

- **Adoption Tracking:** Monitor real-world usage and adoption

- **Developer Ecosystem:** Analyze developer activity and project growth

- **Partnership Analysis:** Track strategic partnerships and integrations

- **Regulatory Impact:** Assess regulatory developments and compliance

Investment Signal Generation:

- **Technical Breakouts:** Identify technical breakouts in scaling tokens

- **Fundamental Shifts:** Detect changes in network fundamentals

- **Adoption Acceleration:** Alert when adoption metrics improve

- **Risk Warnings:** Notify about potential technical or market risks

The platform's 74% win rate is achieved through superior blockchain analysis that helps traders identify high-potential scaling solution opportunities and avoid common pitfalls that plague traditional analysis methods.

Consensus Mechanism Upgrades:

- **Proof of Stake Transitions:** Invest in projects transitioning to PoS

- **Staking Opportunities:** Earn rewards by staking Layer 1 tokens

- **Validator Economics:** Understand validator incentives and rewards

- **Network Security:** Assess security implications of consensus changes

- **Long-term Value:** Focus on sustainable economic models

Technical Innovation:

- **Sharding Implementation:** Invest in projects implementing sharding

- **Protocol Upgrades:** Monitor major protocol improvements

- **Developer Tools:** Track development of developer tools and SDKs

- **Interoperability:** Focus on cross-chain communication solutions

- **Security Enhancements:** Invest in security-focused improvements

Rollup Solutions:

- **Optimistic Rollups:** Invest in optimistic rollup projects

- **ZK Rollups:** Focus on zero-knowledge rollup solutions

- **Hybrid Approaches:** Consider hybrid rollup implementations

- **Developer Adoption:** Monitor developer migration to Layer 2

- **Ecosystem Growth:** Track DeFi and NFT adoption on Layer 2

Sidechain Investments:

- **Independent Sidechains:** Invest in standalone sidechain solutions

- **Bridge Technology:** Focus on cross-chain bridge solutions

- **Liquidity Mining:** Participate in Layer 2 liquidity mining programs

- **Governance Tokens:** Invest in Layer 2 governance tokens

- **Partnership Opportunities:** Track strategic partnerships and integrations

To illustrate how blockchain scaling analysis works in practice, let's examine how SoroMM's AI-powered platform applies these principles to real scaling solution investments and market conditions.

**Scenario:** Ethereum's transition to Proof of Stake and Layer 2 adoption

**Traditional Analysis:** Basic metrics, limited technical understanding

**SoroMM AI Analysis:** Comprehensive technical analysis, adoption tracking, risk assessment

Results:

- **Technical Analysis:** AI identified successful PoS transition indicators

- **Adoption Tracking:** Monitored Layer 2 adoption and user migration

- **Risk Assessment:** Evaluated technical risks and market implications

- **Investment Signal:** Provided optimal entry points for scaling investments

- **Outcome:** 200%+ returns on scaling solution investments

**Scenario:** Polygon and Arbitrum ecosystem expansion and adoption

**Traditional Analysis:** Limited ecosystem analysis, basic metrics

**SoroMM AI Analysis:** Comprehensive ecosystem analysis, developer tracking, adoption metrics

Results:

- **Ecosystem Analysis:** AI identified strong developer and user growth

- **Developer Tracking:** Monitored code commits and project development

- **Adoption Metrics:** Tracked real-world usage and transaction volume

- **Investment Signal:** Identified optimal entry points for Layer 2 tokens

- **Outcome:** 300%+ returns on Layer 2 investments

As blockchain technology evolves and adoption increases, the edge in scaling solution analysis comes from:

- **Real-time performance monitoring** using AI and blockchain analytics

- **Multi-chain analysis** for comprehensive market understanding

- **Adoption tracking** for identifying successful scaling solutions

- **Risk assessment automation** for identifying potential issues

SoroMM represents the next evolution in blockchain analysis, combining traditional technical analysis with AI-powered insights to provide traders with institutional-grade tools previously available only to professional blockchain analysts.

Cross-Chain Comparison:

- **Performance Metrics:** Compare TPS, fees, and latency across chains

- **Developer Activity:** Analyze developer migration and ecosystem growth

- **User Adoption:** Track user migration and transaction volume

- **Security Assessment:** Evaluate security models and risk factors

- **Economic Models:** Compare tokenomics and incentive structures

Interoperability Analysis:

- **Bridge Technology:** Analyze cross-chain bridge solutions

- **Liquidity Flow:** Track liquidity movement between chains

- **Arbitrage Opportunities:** Identify cross-chain arbitrage opportunities

- **Network Effects:** Understand network effects and ecosystem growth

- **Competitive Dynamics:** Analyze competitive positioning and differentiation

Portfolio Diversification:

- **Layer 1 Allocation:** Diversify across different Layer 1 solutions

- **Layer 2 Exposure:** Include Layer 2 solutions in portfolio

- **Risk Management:** Balance risk across different scaling approaches

- **Liquidity Management:** Ensure sufficient liquidity for positions

- **Rebalancing:** Regular portfolio rebalancing based on performance

Advanced Risk Controls:

- **Technical Risk Assessment:** Evaluate technical risks and vulnerabilities

- **Market Risk Management:** Manage market volatility and correlation

- **Regulatory Monitoring:** Track regulatory developments and compliance

- **Liquidity Analysis:** Assess liquidity risks and exit strategies

- **Performance Tracking:** Monitor performance relative to benchmarks

Blockchain scaling represents one of the most important developments in the cryptocurrency ecosystem, with significant implications for traders and investors. Understanding the differences between Layer 1 and Layer 2 solutions is essential for identifying profitable opportunities in this rapidly evolving sector.

1. **Scaling solutions are essential** - Blockchain scaling is critical for mass adoption

2. **Layer 1 vs Layer 2 trade-offs** - Each approach has unique advantages and disadvantages

3. **Technical analysis matters** - Understanding technical fundamentals is crucial

4. **Adoption tracking is valuable** - Real-world usage drives long-term value

5. **Risk management is essential** - Scaling solutions carry unique risks

6. **Use institutional-grade tools** - Leverage AI-powered platforms like SoroMM

7. **Stay updated** - Blockchain scaling technology evolves rapidly

1. **Study scaling fundamentals** - Learn about different scaling approaches

2. **Monitor technical developments** - Track protocol upgrades and improvements

3. **Analyze adoption metrics** - Monitor real-world usage and growth

4. **Use institutional-grade tools** - Leverage AI-powered platforms like SoroMM

5. **Diversify across solutions** - Spread risk across different scaling approaches

6. **Track your analysis** - Monitor how scaling analysis improves results

7. **Stay informed** - Keep learning about new scaling technologies

- **Books:** "Mastering Ethereum" by Andreas Antonopoulos

- **Courses:** Blockchain technology and scaling solution courses

- **Practice:** Use blockchain explorers to analyze network metrics

- **Community:** Join blockchain development and trading communities

- **Tools:** Explore AI-powered platforms for enhanced blockchain analysis

Remember, blockchain scaling is a complex and rapidly evolving field. The most successful traders are those who combine technical understanding with proper risk management and institutional-grade analysis tools.

---

**Ready to master blockchain scaling analysis with institutional-grade tools?** Discover how SoroMM's AI-powered platform can enhance your blockchain analysis with real-time performance monitoring and adoption tracking. Join thousands of traders who are already using AI technology to identify high-potential scaling solution opportunities.