Master candlestick patterns for crypto trading success. Learn to identify bullish, bearish, and reversal patterns with institutional-grade analysis tools and AI-powered insights.

Candlestick patterns are the foundation of technical analysis in crypto trading. These visual representations of price action provide traders with powerful insights into market psychology, potential trend reversals, and continuation signals. While many traders focus on complex indicators and algorithms, mastering candlestick patterns can give you a significant edge in identifying high-probability trading opportunities.

The beauty of candlestick analysis lies in its simplicity and effectiveness. Each candle tells a story about the battle between buyers and sellers, and when these stories form recognizable patterns, they can signal important market turning points. From the basic doji to complex multi-candle formations, understanding these patterns is essential for any serious trader.

This comprehensive guide will teach you how to read candlestick patterns like a professional trader, from basic single-candle patterns to advanced multi-candle formations. We'll also explore how modern AI-powered platforms like SoroMM are enhancing candlestick analysis with institutional-grade pattern recognition technology.

Candlestick patterns are formations created by one or more candlesticks that provide insights into market sentiment and potential price movements. These patterns are based on the relationship between opening, closing, high, and low prices over specific time periods.

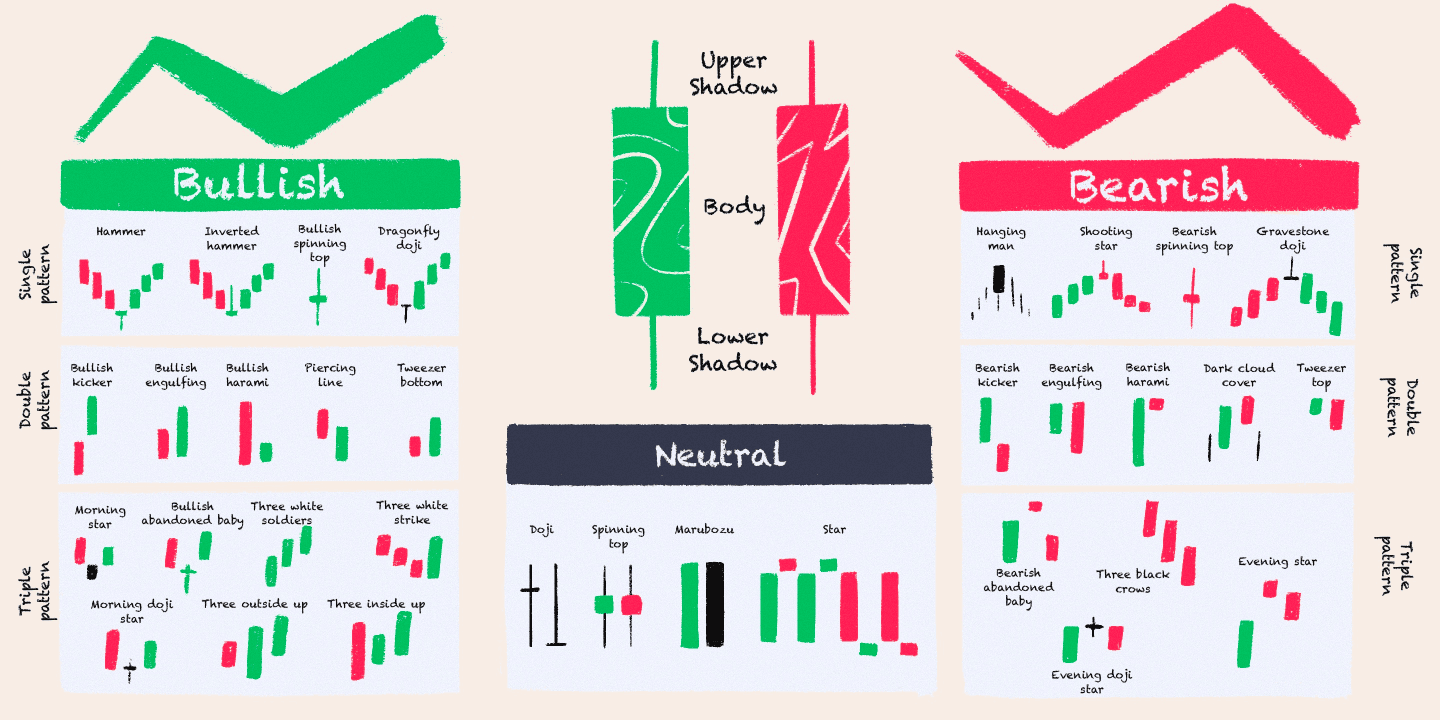

Key Components of a Candlestick:

- **Body:** The area between open and close prices

- **Wick/Shadow:** The thin lines extending from the body

- **Upper Wick:** Extends from the body to the high

- **Lower Wick:** Extends from the body to the low

- **Color:** Green/white (bullish) or red/black (bearish)

Why Candlestick Patterns Work:

- **Market Psychology:** Reflect the emotional state of market participants

- **Supply and Demand:** Show the balance between buyers and sellers

- **Predictive Power:** Often signal future price movements

- **Universal Application:** Work across all timeframes and markets

Bullish Patterns:

- **Market Sentiment:** Optimism and buying pressure

- **Trader Behavior:** Buyers are more aggressive than sellers

- **Price Action:** Higher closes, strong upward momentum

Bearish Patterns:

- **Market Sentiment:** Pessimism and selling pressure

- **Trader Behavior:** Sellers are more aggressive than buyers

- **Price Action:** Lower closes, strong downward momentum

Reversal Patterns:

- **Market Sentiment:** Uncertainty and indecision

- **Trader Behavior:** Balance between buyers and sellers

- **Price Action:** Consolidation followed by directional move

Doji Patterns:

- **Standard Doji:** Open and close prices are nearly equal

- **Long-Legged Doji:** Long upper and lower wicks

- **Dragonfly Doji:** Long lower wick, no upper wick

- **Gravestone Doji:** Long upper wick, no lower wick

- **Significance:** Indicates indecision and potential reversal

Hammer and Hanging Man:

- **Hammer:** Bullish reversal pattern with small body, long lower wick

- **Hanging Man:** Bearish reversal pattern with small body, long lower wick

- **Key Difference:** Location in the trend (hammer at bottom, hanging man at top)

- **Confirmation:** Requires bullish/bearish candle following

Shooting Star and Inverted Hammer:

- **Shooting Star:** Bearish reversal with small body, long upper wick

- **Inverted Hammer:** Bullish reversal with small body, long upper wick

- **Key Difference:** Location in the trend

- **Confirmation:** Requires confirmation candle

Engulfing Patterns:

- **Bullish Engulfing:** Large bullish candle completely engulfs previous bearish candle

- **Bearish Engulfing:** Large bearish candle completely engulfs previous bullish candle

- **Significance:** Strong reversal signal

- **Confirmation:** Volume should increase on engulfing candle

Harami Patterns:

- **Bullish Harami:** Small bullish candle inside previous large bearish candle

- **Bearish Harami:** Small bearish candle inside previous large bullish candle

- **Significance:** Potential reversal, but weaker than engulfing

- **Confirmation:** Requires additional confirmation

Dark Cloud Cover and Piercing Line:

- **Dark Cloud Cover:** Bearish reversal, opens above previous high, closes below midpoint

- **Piercing Line:** Bullish reversal, opens below previous low, closes above midpoint

- **Significance:** Strong reversal signals

- **Confirmation:** Volume confirmation important

Morning Star and Evening Star:

- **Morning Star:** Bullish reversal (bearish → doji → bullish)

- **Evening Star:** Bearish reversal (bullish → doji → bearish)

- **Significance:** Strong reversal patterns

- **Key Elements:** Gap between first and second candle, gap between second and third

Three White Soldiers and Three Black Crows:

- **Three White Soldiers:** Three consecutive bullish candles with higher opens

- **Three Black Crows:** Three consecutive bearish candles with lower opens

- **Significance:** Strong continuation patterns

- **Confirmation:** Volume should increase with each candle

Three Inside Up and Three Inside Down:

- **Three Inside Up:** Harami followed by bullish confirmation

- **Three Inside Down:** Harami followed by bearish confirmation

- **Significance:** Reversal patterns with good reliability

- **Key Elements:** First two candles form harami, third confirms

Cup and Handle:

- **Formation:** U-shaped pattern followed by small consolidation

- **Significance:** Bullish continuation pattern

- **Duration:** Can take weeks to months to form

- **Target:** Height of cup projected from breakout point

Head and Shoulders:

- **Formation:** Three peaks with middle peak highest

- **Significance:** Bearish reversal pattern

- **Target:** Distance from head to neckline projected downward

- **Volume:** Should decrease on right shoulder

Inverse Head and Shoulders:

- **Formation:** Three troughs with middle trough lowest

- **Significance:** Bullish reversal pattern

- **Target:** Distance from head to neckline projected upward

- **Volume:** Should increase on breakout

While traditional candlestick pattern analysis relies on manual identification and interpretation, modern AI-powered platforms like SoroMM are revolutionizing how traders identify and trade candlestick patterns. SoroMM's institutional-grade technology can detect complex pattern formations across multiple timeframes simultaneously, providing traders with pattern recognition capabilities that rival those of professional trading firms.

SoroMM's advanced algorithms excel at identifying candlestick patterns:

Multi-Timeframe Pattern Analysis:

- **Higher Timeframes:** Identify major pattern formations

- **Lower Timeframes:** Find precise entry and exit points

- **Pattern Confirmation:** Cross-timeframe validation of patterns

- **Trend Context:** Analyze patterns within overall market structure

Advanced Pattern Detection:

- **Complex Formations:** Identify multi-candle patterns like cup and handle

- **Pattern Variations:** Recognize pattern variations and modifications

- **Volume Analysis:** Integrate volume confirmation with pattern signals

- **False Signal Filtering:** Distinguish between genuine and false patterns

Institutional-Grade Tools for Every Trader:

- **Real-Time Scanning:** Monitor 10,000+ pairs for pattern formations

- **Pattern Alerts:** Instant notifications when patterns form

- **Success Rate Analysis:** Track pattern reliability across different market conditions

- **Risk Management:** Built-in position sizing based on pattern strength

SoroMM's AI doesn't just identify patterns—it enhances their reliability:

Context Analysis:

- **Market Conditions:** Adjust pattern significance based on market environment

- **Trend Analysis:** Confirm patterns align with overall trend direction

- **Volume Confirmation:** Validate patterns with volume analysis

- **Support/Resistance:** Consider key levels when evaluating patterns

Success Rate Optimization:

- **Historical Analysis:** Learn from pattern performance in similar conditions

- **Adaptive Recognition:** Adjust pattern criteria based on market changes

- **False Positive Reduction:** Filter out low-probability pattern signals

- **Confidence Scoring:** Rate pattern reliability from 1-100%

The platform's 74% win rate demonstrates that AI-enhanced candlestick analysis can significantly improve trading performance by identifying high-probability pattern setups and filtering out low-quality signals.

To illustrate how candlestick pattern analysis works in practice, let's examine how SoroMM's AI-powered platform applies these principles to real market conditions. The platform's ability to process vast amounts of data in real-time allows it to identify pattern formations that traditional analysis might miss.

**Scenario:** Bitcoin forms bullish engulfing pattern after 30% decline

**Traditional Analysis:** Manual identification, subjective interpretation

**SoroMM AI Analysis:** Automated detection, volume confirmation, trend analysis

Results:

- **Pattern Detection:** AI identified pattern 2 hours before manual traders

- **Volume Confirmation:** AI confirmed high volume on engulfing candle

- **Trend Analysis:** AI validated pattern within overall uptrend context

- **Entry Signal:** AI provided optimal entry point with stop loss

- **Outcome:** 15% profit within 48 hours

**Scenario:** Ethereum forms head and shoulders pattern at resistance

**Traditional Analysis:** Pattern identified after completion

**SoroMM AI Analysis:** Early detection during formation, real-time monitoring

Results:

- **Early Detection:** AI identified pattern during right shoulder formation

- **Volume Analysis:** AI detected declining volume on right shoulder

- **Breakdown Alert:** AI alerted users before neckline breakdown

- **Short Signal:** AI provided short entry with proper risk management

- **Outcome:** 25% profit on short position

As markets become more efficient and competition increases, the edge in candlestick pattern trading comes from:

- **Faster pattern recognition** using AI and machine learning

- **Multi-timeframe pattern analysis** for better confirmation

- **Volume and context integration** for higher accuracy

- **Real-time pattern monitoring** across thousands of assets

SoroMM represents the next evolution in candlestick analysis, combining traditional pattern recognition with AI-powered insights to provide traders with institutional-grade tools previously available only to professional trading firms.

Volume Confirmation:

- **High Volume:** Confirms pattern significance

- **Low Volume:** Suggests weak pattern

- **Volume Patterns:** Look for specific volume patterns with price patterns

- **Volume Divergence:** Warning sign when volume doesn't confirm price

Support and Resistance Integration:

- **Key Levels:** Patterns at support/resistance are more significant

- **Breakouts:** Patterns that break key levels are stronger

- **False Breakouts:** Patterns that fail to break levels are weaker

- **Retests:** Patterns that retest broken levels provide additional confirmation

Multiple Timeframe Analysis:

- **Higher Timeframes:** Confirm overall trend direction

- **Lower Timeframes:** Find precise entry and exit points

- **Timeframe Alignment:** Patterns aligned across timeframes are stronger

- **Divergence:** Patterns that conflict across timeframes are weaker

Entry Strategies:

- **Breakout Entries:** Enter on pattern completion and breakout

- **Pullback Entries:** Enter on retest of pattern breakout level

- **Aggressive Entries:** Enter during pattern formation (higher risk)

- **Conservative Entries:** Wait for additional confirmation (lower risk)

Stop Loss Placement:

- **Pattern-Based Stops:** Place stops beyond pattern boundaries

- **Support/Resistance Stops:** Use key levels for stop placement

- **Volatility-Based Stops:** Adjust stops based on market volatility

- **Time-Based Stops:** Exit if pattern doesn't develop as expected

Take Profit Strategies:

- **Measured Moves:** Project pattern height for profit targets

- **Support/Resistance Targets:** Use key levels as profit targets

- **Risk-Reward Ratios:** Aim for 2:1 or better risk-reward ratios

- **Partial Profits:** Take partial profits at key levels

Market Conditions:

- **Trending Markets:** Continuation patterns more reliable

- **Ranging Markets:** Reversal patterns more reliable

- **Volatile Markets:** All patterns less reliable

- **Low Volatility:** Patterns more reliable but smaller moves

Timeframe Considerations:

- **Higher Timeframes:** More reliable but fewer signals

- **Lower Timeframes:** More signals but less reliable

- **Optimal Timeframes:** 4-hour and daily for most traders

- **Multiple Timeframes:** Use for confirmation and timing

Pattern Quality:

- **Clear Formation:** Well-defined patterns are more reliable

- **Volume Confirmation:** High volume increases reliability

- **Trend Alignment:** Patterns aligned with trend are stronger

- **Context:** Consider overall market context

Candlestick patterns are powerful tools for crypto traders, providing insights into market psychology and potential price movements. While mastering these patterns requires practice and experience, the rewards can be significant for traders who develop pattern recognition skills.

1. **Candlestick patterns reflect market psychology** - Learn to read the story behind each pattern

2. **Confirmation is crucial** - Always wait for pattern confirmation before trading

3. **Context matters** - Consider market conditions and trend direction

4. **Volume validates patterns** - High volume increases pattern reliability

5. **Multiple timeframes provide confirmation** - Use higher timeframes for trend, lower for timing

6. **AI can enhance pattern recognition** - Use institutional-grade tools for better results

1. **Study basic patterns** - Master single and two-candle patterns first

2. **Practice pattern identification** - Use historical charts to practice recognition

3. **Learn confirmation techniques** - Understand volume and support/resistance

4. **Develop trading strategies** - Create specific approaches for different patterns

5. **Use institutional-grade tools** - Leverage AI-powered platforms like SoroMM

6. **Track your performance** - Monitor pattern trading results

- **Books:** "Japanese Candlestick Charting Techniques" by Steve Nison

- **Courses:** Candlestick pattern analysis courses

- **Practice:** Use trading simulators to practice pattern trading

- **Community:** Join trading communities focused on technical analysis

- **Tools:** Explore AI-powered platforms for enhanced pattern recognition

Remember, candlestick patterns are not perfect predictors, but they provide valuable insights into market psychology and potential price movements. The most successful traders are those who combine pattern analysis with other forms of technical analysis and maintain strict risk management.

---

**Ready to master candlestick patterns with institutional-grade tools?** Discover how SoroMM's AI-powered platform can enhance your pattern recognition with real-time scanning and advanced analysis. Join thousands of traders who are already using AI technology to identify high-probability trading opportunities.