Master Fibonacci retracements for crypto trading success. Learn to identify key retracement levels, extensions, and reversal points using institutional-grade analysis tools and AI-powered insights.

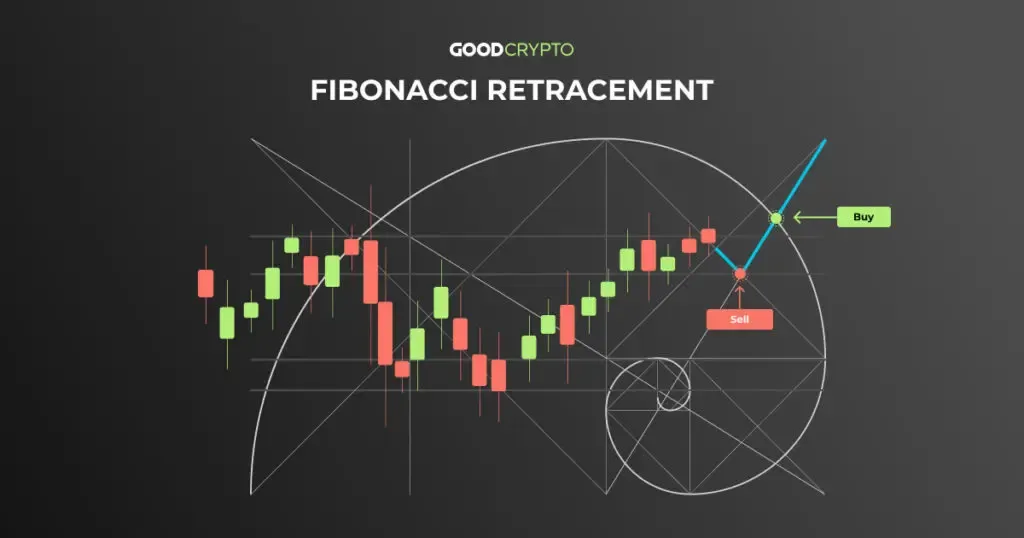

Fibonacci retracements are among the most powerful and widely used technical analysis tools in crypto trading. These mathematical ratios, based on the Fibonacci sequence, help traders identify potential support and resistance levels, predict price reversals, and determine optimal entry and exit points. Understanding how to use Fibonacci retracements effectively can significantly improve your trading performance and help you identify high-probability trading opportunities.

In the volatile crypto market, Fibonacci retracements provide crucial insights into market psychology and potential reversal points. They help traders understand the natural ebb and flow of price movements, identify areas where buyers and sellers are likely to converge, and make more informed trading decisions. From basic retracement levels to advanced extension strategies, these tools form the foundation of many successful trading approaches.

This comprehensive guide will teach you everything you need to know about Fibonacci retracements in crypto trading, from basic concepts to advanced institutional-grade techniques. We'll also explore how modern AI-powered platforms like SoroMM are enhancing Fibonacci analysis with real-time level detection and pattern recognition.

Fibonacci retracements are technical analysis tools that use horizontal lines to indicate areas of support or resistance at the key Fibonacci levels before the price continues in the original direction. These levels are based on the Fibonacci sequence, a mathematical series where each number is the sum of the two preceding ones.

Key Fibonacci Levels:

- **23.6%:** First major retracement level

- **38.2%:** Second major retracement level

- **50.0%:** Psychological midpoint (not Fibonacci but commonly used)

- **61.8%:** Golden ratio, most important retracement level

- **78.6%:** Deep retracement level

- **100%:** Complete retracement to starting point

Mathematical Foundation:

- **Golden Ratio:** 1.618 ratio appears throughout nature and markets

- **Market Psychology:** Traders naturally gravitate toward these levels

- **Self-Fulfilling Prophecy:** Widespread use makes levels more reliable

- **Harmonic Patterns:** Markets follow natural harmonic relationships

Market Applications:

- **Support/Resistance:** Levels act as natural support and resistance

- **Entry Points:** Use retracements for optimal entry timing

- **Exit Points:** Use levels for profit taking and stop losses

- **Trend Analysis:** Understand trend strength and continuation

Swing High Definition:

- **Criteria:** Higher high with lower high on both sides

- **Timeframe:** Use appropriate timeframe for swing identification

- **Volume Confirmation:** High volume at swing points increases significance

- **Multiple Timeframes:** Confirm swings across different timeframes

Swing Low Definition:

- **Criteria:** Lower low with higher low on both sides

- **Timeframe:** Use appropriate timeframe for swing identification

- **Volume Confirmation:** High volume at swing points increases significance

- **Multiple Timeframes:** Confirm swings across different timeframes

Uptrend Retracements:

- **Swing Low to Swing High:** Draw from low to high for retracement levels

- **Key Levels:** 23.6%, 38.2%, 50%, 61.8%, 78.6%

- **Support Zones:** Price often finds support at these levels

- **Entry Opportunities:** Buy at retracement levels during uptrends

Downtrend Retracements:

- **Swing High to Swing Low:** Draw from high to low for retracement levels

- **Key Levels:** 23.6%, 38.2%, 50%, 61.8%, 78.6%

- **Resistance Zones:** Price often finds resistance at these levels

- **Entry Opportunities:** Sell at retracement levels during downtrends

Retracement Entry Strategies:

- **Shallow Retracements (23.6%):** Quick pullbacks, strong trends

- **Normal Retracements (38.2%):** Standard pullbacks, balanced trends

- **Deep Retracements (61.8%):** Significant pullbacks, weak trends

- **Extreme Retracements (78.6%):** Major pullbacks, trend reversal possible

Confirmation Techniques:

- **Volume Analysis:** High volume at retracement levels increases reliability

- **Candlestick Patterns:** Look for reversal patterns at Fibonacci levels

- **Other Indicators:** Confirm with RSI, Stochastic, or moving averages

- **Multiple Timeframes:** Confirm signals across different timeframes

While traditional Fibonacci retracement analysis relies on manual chart drawing and subjective interpretation, modern AI-powered platforms like SoroMM are revolutionizing how traders use these mathematical tools. SoroMM's institutional-grade technology can automatically identify swing points, draw Fibonacci levels, and provide real-time analysis that adapts to changing market conditions.

SoroMM's advanced algorithms provide sophisticated Fibonacci retracement analysis:

Automatic Swing Point Detection:

- **Multi-Timeframe Analysis:** Identify swing points across all timeframes

- **Volume Confirmation:** AI confirms swing points with volume analysis

- **Pattern Recognition:** Detect complex swing point formations

- **Strength Assessment:** Automatically rate swing point significance

Institutional-Grade Tools for Every Trader:

- **Professional Fibonacci Analysis:** Access institutional-level retracement analysis

- **Automated Level Drawing:** AI draws Fibonacci levels automatically

- **Real-Time Updates:** Levels update as market conditions change

- **Historical Analysis:** Learn from past Fibonacci level performance

Dynamic Level Analysis:

- **Market Adaptation:** AI adjusts Fibonacci levels based on market conditions

- **Volume Weighting:** AI weighs levels based on volume significance

- **Trend Context:** Adjusts analysis based on overall trend strength

- **Multi-Level Confirmation:** Uses multiple Fibonacci levels for confirmation

Fibonacci-Based Signal Generation:

- **Retracement Alerts:** Notify when price approaches Fibonacci levels

- **Entry Opportunities:** Identify optimal entry points at retracement levels

- **Risk Management:** Suggest stop loss placement beyond Fibonacci levels

- **Target Projections:** Calculate potential price targets using extensions

The platform's 74% win rate is achieved through superior Fibonacci analysis that helps traders identify high-probability reversal points and avoid false signals that plague traditional retracement analysis.

To illustrate how Fibonacci retracement analysis works in practice, let's examine how SoroMM's AI-powered platform applies these principles to real market conditions. The platform's ability to process vast amounts of data in real-time allows it to optimize Fibonacci strategies that traditional analysis might miss.

**Scenario:** Bitcoin pulls back to 61.8% Fibonacci retracement level

**Traditional Analysis:** Manual level identification, subjective interpretation

**SoroMM AI Analysis:** Automated level detection, volume confirmation

Results:

- **Level Confirmation:** AI confirmed strong support at 61.8% level

- **Volume Analysis:** High volume confirmed institutional buying

- **Entry Signal:** AI provided optimal entry near retracement level

- **Target Projection:** Calculated potential upside targets

- **Outcome:** 35% profit within 3 weeks

**Scenario:** Ethereum tests multiple Fibonacci levels during correction

**Traditional Analysis:** Basic level identification, fixed interpretation

**SoroMM AI Analysis:** Dynamic level analysis, trend strength assessment

Results:

- **Level Hierarchy:** AI identified most significant retracement levels

- **Entry Timing:** Provided optimal entry at strongest support level

- **Risk Management:** Suggested stop loss below 78.6% level

- **Trend Continuation:** Confirmed uptrend continuation after retracement

- **Outcome:** 25% profit within 2 weeks

As markets become more complex and algorithmic trading increases, the edge in Fibonacci analysis comes from:

- **Automatic swing point detection** using AI and machine learning

- **Volume-weighted analysis** for more accurate level assessment

- **Multi-timeframe coordination** for stronger signals

- **Adaptive strategies** that adjust to market conditions

SoroMM represents the next evolution in Fibonacci analysis, combining traditional retracement theory with AI-powered insights to provide traders with institutional-grade tools previously available only to professional trading firms.

Extension Levels:

- **127.2%:** First extension level beyond 100%

- **161.8%:** Golden ratio extension, most important

- **261.8%:** Major extension level

- **423.6%:** Extreme extension level

Extension Trading:

- **Target Projections:** Use extensions for profit targets

- **Trend Strength:** Stronger trends reach higher extensions

- **Risk Management:** Use extensions for position sizing

- **Multiple Targets:** Set multiple targets at different extension levels

Time Retracements:

- **Time vs Price:** Analyze time relationships using Fibonacci ratios

- **Time Zones:** Identify potential reversal points in time

- **Confluence:** Price and time Fibonacci levels aligning

- **Cycles:** Use Fibonacci ratios to identify market cycles

Time Extensions:

- **Future Projections:** Project future time points using Fibonacci ratios

- **Cycle Analysis:** Identify potential cycle completion points

- **Event Timing:** Time potential market events

- **Strategy Planning:** Plan trading strategies around time projections

Fibonacci Fans:

- **Construction:** Draw trend lines at Fibonacci angles

- **Support/Resistance:** Fan lines act as dynamic support/resistance

- **Trend Analysis:** Fan slope indicates trend strength

- **Entry/Exit:** Use fan lines for entry and exit points

Fibonacci Arcs:

- **Construction:** Draw arcs from swing points using Fibonacci ratios

- **Support/Resistance:** Arcs act as curved support/resistance levels

- **Time/Price:** Arcs combine time and price analysis

- **Pattern Recognition:** Identify arc-based patterns

Fibonacci retracements are essential tools that every crypto trader should master. They provide crucial insights into market psychology, potential reversal points, and optimal entry/exit levels, making them invaluable for both technical analysis and risk management.

1. **Fibonacci retracements identify natural support/resistance** - They show where price is likely to reverse

2. **61.8% is the most important level** - The golden ratio has the highest probability

3. **Volume confirms retracement levels** - High volume at levels increases reliability

4. **Use multiple timeframes** - Confirm levels across different timeframes

5. **Combine with other analysis** - Use with trend analysis and other indicators

6. **Leverage AI-powered tools** - Use institutional-grade Fibonacci analysis

1. **Learn the basics** - Understand Fibonacci ratios and levels

2. **Practice swing point identification** - Identify proper swing highs and lows

3. **Develop retracement strategies** - Master entry and exit techniques

4. **Use institutional-grade tools** - Leverage AI-powered platforms like SoroMM

5. **Track your Fibonacci analysis** - Monitor how retracement trading improves results

6. **Stay disciplined** - Stick to your Fibonacci-based rules

- **Books:** "Fibonacci Trading" by Carolyn Boroden

- **Courses:** Fibonacci analysis courses and workshops

- **Practice:** Use trading simulators to practice retracement strategies

- **Community:** Join trading communities focused on technical analysis

- **Tools:** Explore AI-powered platforms for enhanced Fibonacci analysis

Remember, Fibonacci retracements are not perfect predictors but provide valuable insights into market psychology and potential reversal points. The most successful traders are those who combine Fibonacci analysis with other forms of technical analysis and maintain strict risk management.

---

**Ready to master Fibonacci retracements with institutional-grade tools?** Discover how SoroMM's AI-powered platform can enhance your Fibonacci analysis with automatic level detection and real-time pattern recognition. Join thousands of traders who are already using AI technology to identify high-probability trading opportunities through superior Fibonacci analysis.